Fairfax County adopted a new program on September 15, 2020, that provides an economic incentive to the private sector to purchase, assemble, revitalize and redevelop property for economic development purposes. Called the Economic Incentive Program or EIP, the program was established by ordinance. The ordinance amends Chapter 4 of the County Code to create a new Article 29 entitled “Incentives to Encourage Economic Growth”.

View a video presentation of the Economic Incentive Program

Financial and Regulatory Incentives

Financial incentives include a ten percent reduction of site plan fees and a partial abatement of the real estate taxes on the difference between the base value of a property and its post-development value, including any increase or decrease in the annual assessed value of the tax-exempt portion of the property. In addition to the financial incentives, there are regulatory incentives such as expedited scheduling of zoning applications, concurrent processing of a Comprehensive Plan amendment and zoning application, and concurrent processing of a site plan with a zoning application.

Eligibility Requirements

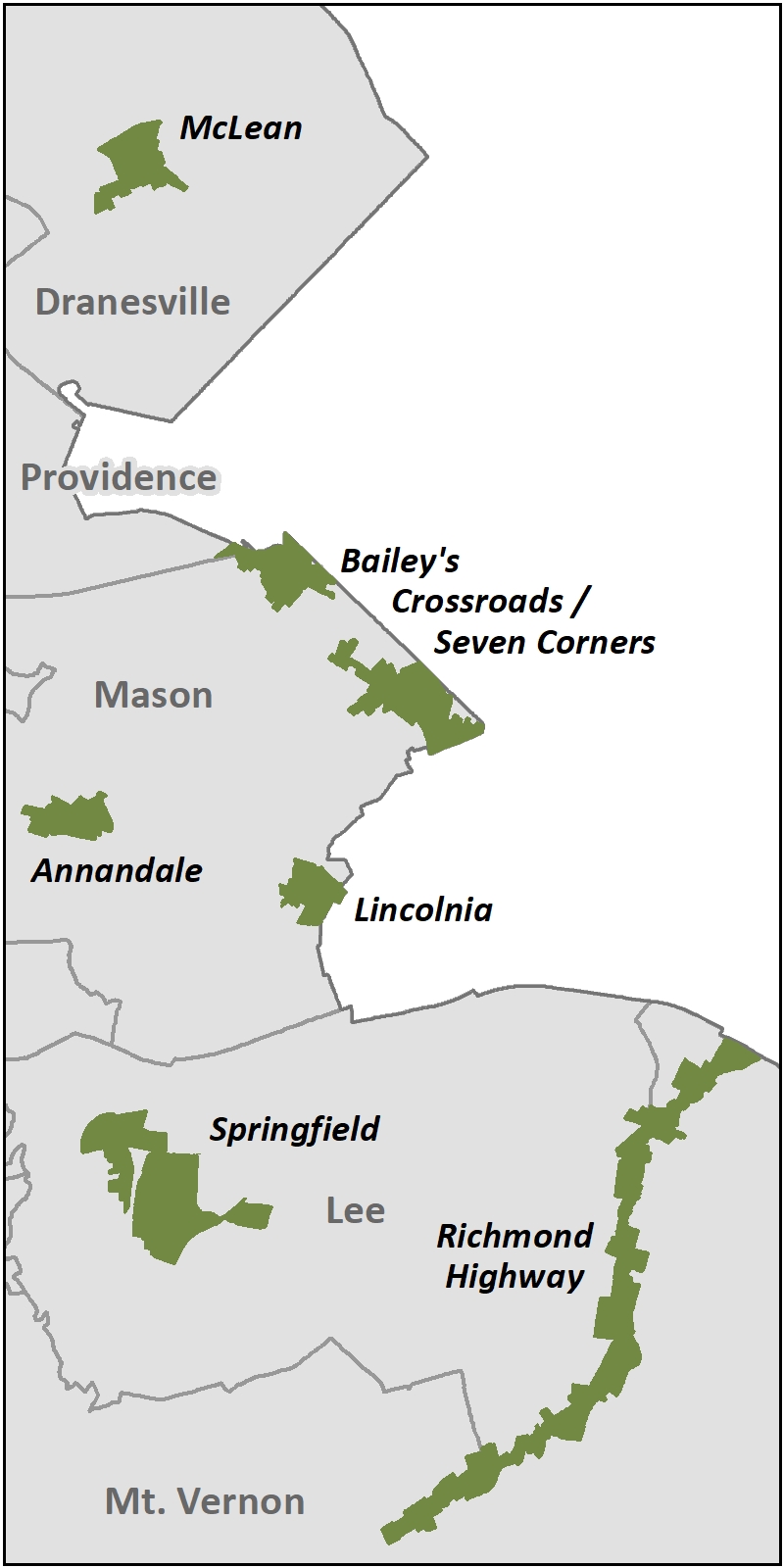

- The development proposal must be located within one of the six designated Economic Incentive Areas:

- Annandale Commercial Revitalization District (CRD)

- Bailey's Crossroads / Seven Corners CRD

- McLean CRD

- Lincolnia Commercial Revitalization Area (CRA)

- Richmond Highway CRD, adjacent Suburban Neighborhood Areas, and portions of the Huntington Transit Station Area (TSA): Map 1, Map 2, Map 3

- Springfield CRD and the non-single family portion the Springfield TSA

- The proposed development must be commercial, industrial, and/or multi-family residential

- The application must contain a newly proposed assemblage, not previously submitted for rezoning or site plan approval of at least 2 contiguous parcels, with different owners, totaling a minimum of two acres. However, the Board of Supervisors may make an exception regarding the minimum size of consolidation.

- The proposal must be consistent with the consolidation and use recommendations of the Comprehensive Plan, and all laws and policies related to the provision and preservation of affordable housing.

Economic Incentive Areas - Effective Dates

Each Economic Incentive Area is in effect for a period of ten-years. This timeframe is the period within which a qualifying property will be able to avail themselves of the partial real estate tax abatement. The partial real estate tax abatement does not extend beyond the specified timeframes, regardless of when a property becomes qualifying.

-

Annandale Incentive Area: January 1, 2025 to December 31, 2034

-

Bailey's Crossroads / Seven Corners Incentive Area: July 1, 2022 to June 30, 2032

-

Lincolnia Incentive Area: January 1 2025 to December 31, 2034

-

McLean Incentive Area: July 1, 2024 to June 30, 2034

-

Richmond Highway Incentive Area: July 1, 2024 to June 30, 2034

-

Springfield Incentive Area: July 1, 2024 to June 30 2034

Application Process and Documents

Prior to filing an application with the Fairfax County Department of Planning and Development, Community Revitalization Section; applicants should review the ordinance eligibility criteria. Contact DPD's Community Revitalization Section for assistance in determining eligibility at 703-324-9300. A summary of the application process can be seen in the adjacent chart (click to enlarge). For a detailed description of the application requirements and process, please read the EIP Requirements and Procedures.

Prior to filing an application with the Fairfax County Department of Planning and Development, Community Revitalization Section; applicants should review the ordinance eligibility criteria. Contact DPD's Community Revitalization Section for assistance in determining eligibility at 703-324-9300. A summary of the application process can be seen in the adjacent chart (click to enlarge). For a detailed description of the application requirements and process, please read the EIP Requirements and Procedures.

To request either a Final Base Value or a Final Fair Market Value of your property, please use the following DocuSign PowerForms: